Every day, someone in Perth clicks a link that looks like it’s from their bank-only to lose everything. It’s not magic. It’s phishing. And it’s getting smarter. You don’t need to be a tech expert to fall for it. You just need to be human. Scammers don’t hack your computer. They hack your trust. They send emails that look real. Texts that feel urgent. Calls that sound official. And if you’ve ever thought, ‘That can’t happen to me,’ you’re already in the target zone.

Some people even turn to shady services like dubai escort service for quick thrills, ignoring the risks in their personal lives. That same carelessness is what lets phishing thrive. If you’re not careful about who you trust online, it doesn’t matter how secure your password is.

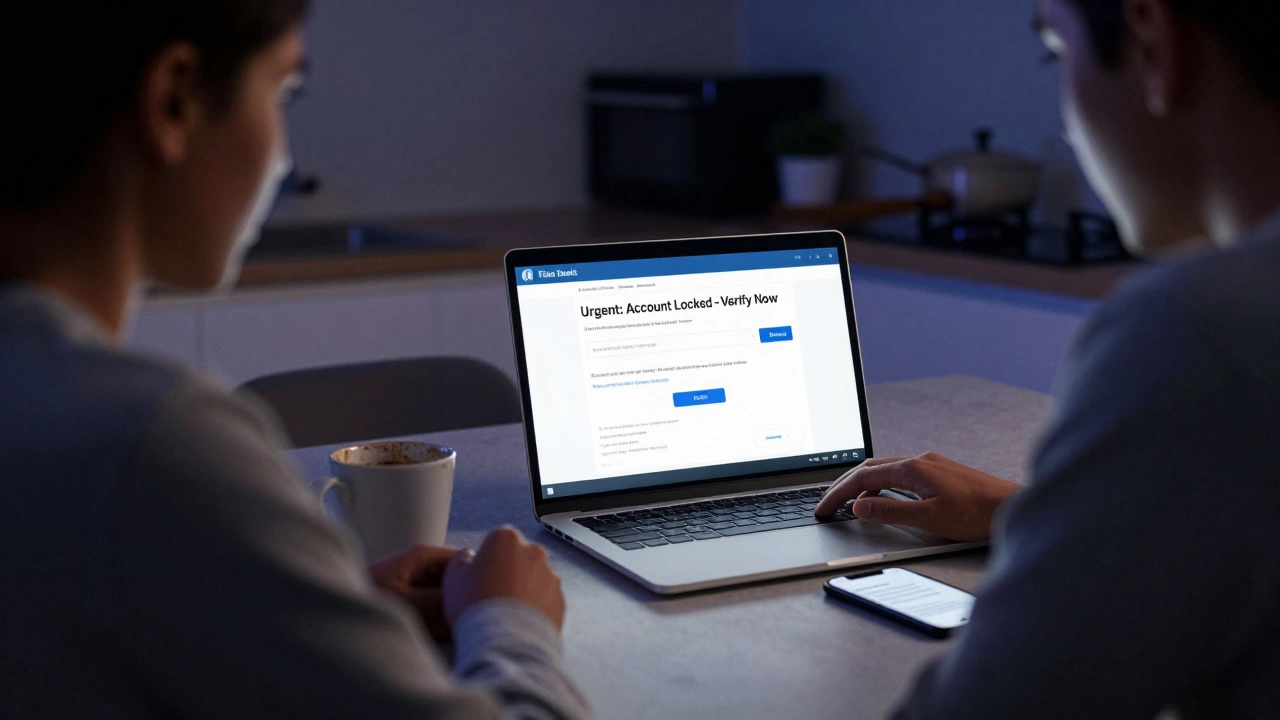

What Phishing Actually Looks Like

Phishing isn’t one thing. It’s a hundred tiny lies dressed up as one big opportunity. A fake invoice from ‘Amazon’. A message from ‘Apple Support’ saying your account is locked. A LinkedIn DM from someone claiming to be a recruiter with a job offer that pays $10,000 a week. All of them ask for the same thing: your login details, your credit card, or your Social Security number.

Here’s the trick: they don’t need to be perfect. Just good enough. A misspelled domain like ‘amaz0n.com’ or a logo that’s slightly off. A sense of panic: ‘Your account will be deleted in 24 hours!’ Or a false sense of reward: ‘You’ve won a free iPhone!’

Real companies don’t ask you to reset your password through a link in an email. They don’t call you out of the blue to fix your ‘security issue’. If you get a message like that, pause. Breathe. Don’t click. Don’t reply. Go directly to the official website by typing the address yourself.

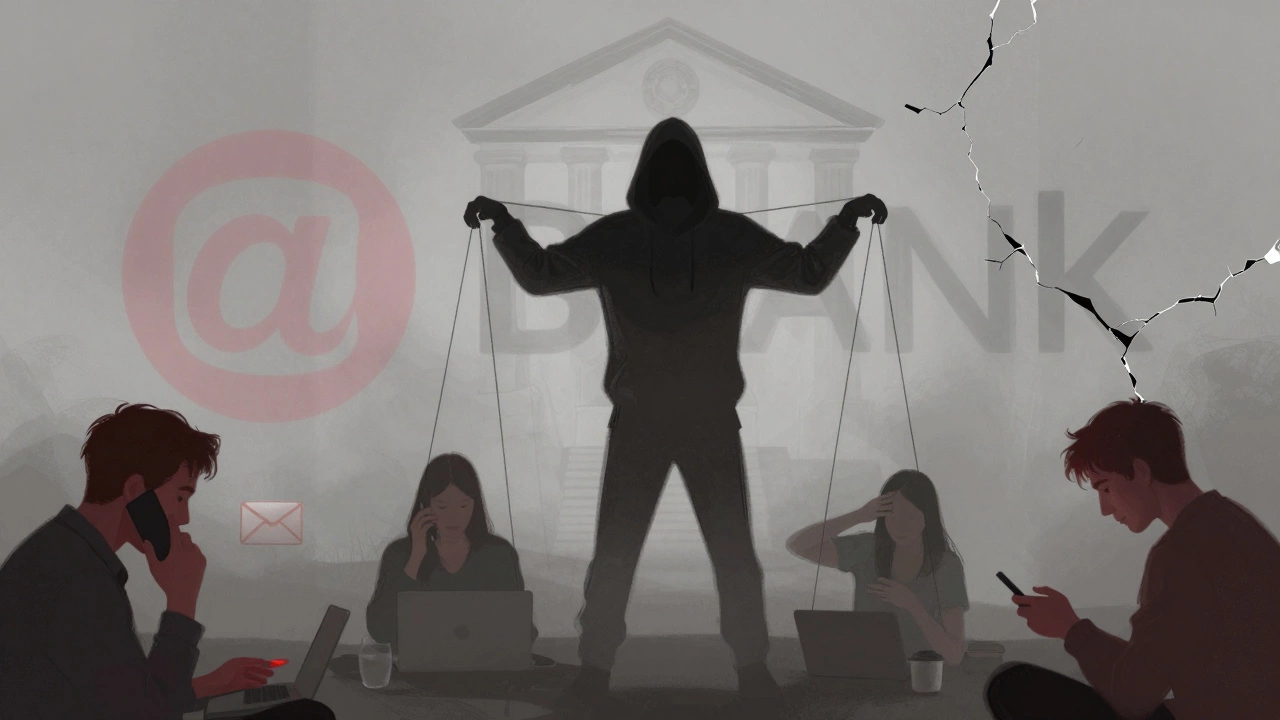

The Psychology Behind the Scam

Why do people fall for this? Because scammers know how we think. We’re wired to respond to urgency. To authority. To familiarity. A phishing email that looks like it’s from your boss? You’ll reply faster. One that says ‘Your package couldn’t be delivered’? You’ll click to track it.

They use social engineering-manipulating emotions, not software. A recent study from the University of California found that 92% of phishing attempts succeed because of human error, not system flaws. That’s not a bug. That’s the design.

Think about it: when was the last time you got a text from ‘NAB’ saying your account was compromised? If you clicked without checking, you weren’t stupid. You were tired. You were distracted. You were human. That’s exactly what they count on.

How to Spot a Phishing Email

Here’s a simple checklist you can use right now:

- Check the sender’s email address-not just the name. ‘[email protected]’ is real. ‘[email protected]’ is fake.

- Hover over links before clicking. See where they actually lead. If it says ‘https://nab.com.au/login’ but the link goes to ‘https://secure-login-fake.com’, walk away.

- Look for poor grammar or strange phrasing. ‘Dear Valued Customer’ is fine. ‘Dear Valued Costumer’ is not.

- Ask yourself: Why now? Is this urgent? Is it too good to be true? Is it asking for something you didn’t sign up for?

- Never download attachments from unknown senders. Even a PDF can carry malware.

And if you’re still unsure? Call the company using the number on their official website-not the one in the email.

What Happens After You Click

Clicking a phishing link doesn’t always mean instant disaster. Sometimes, it just opens a door. The attacker installs a keylogger. Steals your cookies. Gains access to your email. Then they use your email to phish your friends. Or they log into your bank account while you sleep.

One woman in Melbourne lost $47,000 after clicking a fake Telstra bill. She thought she was paying it. The scammer had cloned the real page-down to the logo, the layout, even the font. The only difference? The payment went to a bank in Cyprus.

Recovery is hard. Banks can reverse some transactions, but only if you act fast. Most don’t. And once your identity is stolen, rebuilding your credit can take years.

How to Protect Yourself

You don’t need fancy software. You need habits.

- Use two-factor authentication (2FA) on every account that offers it. Not SMS if you can help it-use an authenticator app like Google Authenticator or Authy.

- Use a password manager. It generates strong, unique passwords for every site. You only need to remember one.

- Turn on alerts on your bank and email accounts. Get notified when a login happens from a new device.

- Update your devices. Outdated software has known holes. Patch them.

- Teach your family. Grandparents, kids, partners-they’re all targets. Show them how to check an email before clicking.

And if you’ve already clicked something suspicious? Change your passwords immediately. Run a malware scan. Contact your bank. Don’t wait. Don’t hope it was a mistake. Assume the worst-and act.

Phishing Isn’t Going Away

It’s getting worse. In 2025, phishing attacks increased by 34% compared to last year. AI tools now write convincing emails in seconds. They can mimic your boss’s writing style. They can generate fake voicemails that sound exactly like your accountant.

There’s a new trend called ‘vishing’-voice phishing. You get a call from someone pretending to be from Microsoft. They say your computer is infected. They ask you to download a remote tool. Then they take control. That’s happening in Perth right now.

And if you think you’re safe because you don’t use social media? Think again. Scammers get your info from data leaks, public records, or even your LinkedIn profile. Your name, job, location, pet’s name-all of it is out there. They use it to make their lies feel real.

That’s why you can’t just rely on tech. You need to stay skeptical. Always.

What to Do If You’re Scammed

If you’ve lost money or given away personal info:

- Call your bank immediately. Freeze your cards.

- Change all your passwords, especially email and banking.

- Report it to the Australian Cyber Security Centre (ACSC) at cyber.gov.au.

- Check your credit report. Freeze it if needed.

- Tell someone you trust. Don’t isolate yourself. Scammers count on shame to keep you quiet.

You’re not alone. Over 100,000 Australians reported phishing scams last year. That’s not a failure. It’s a wake-up call.

Final Thought: Trust, But Verify

Security isn’t about being paranoid. It’s about being smart. You don’t have to live in fear. But you do have to question everything. That email? Verify. That call? Hang up and call back. That offer? Look it up yourself.

And if you ever find yourself tempted by something too easy-like nutten dubai or dubai nutten-remember: the same impulse that makes you click on a scam link is the same one that makes you ignore red flags in other areas of your life. Stay sharp. Everywhere.

What should I do if I clicked a phishing link?

Immediately disconnect from the internet, change your passwords for all important accounts (email, banking, social media), run a malware scan using trusted software like Malwarebytes, and contact your bank if financial info was entered. Report the incident to the Australian Cyber Security Centre.

Can phishing happen through text messages?

Yes. This is called ‘smishing’. Scammers send fake texts pretending to be from your bank, delivery services, or government agencies. Never click links or reply. Delete the message and contact the company directly using their official number.

Is two-factor authentication enough to stop phishing?

It helps a lot, but it’s not foolproof. If you use SMS-based 2FA, attackers can hijack your number. Use an authenticator app instead. Even then, if you give away your password, they can still log in-so never share it, even if someone claims to be from tech support.

How do I know if a website is fake?

Look for HTTPS and a padlock icon, but that’s not enough. Check the domain name closely. Fake sites often use misspellings, extra letters, or strange domains (.xyz, .info). Compare it to the official site by typing the address yourself. If it looks off, leave.

Why do scammers target regular people, not just businesses?

Because regular people are easier to trick. Businesses have security teams. Individuals don’t. A single click from one person can give access to hundreds of accounts. Scammers cast wide nets. You don’t need to be rich to be a target-you just need to be online.